|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

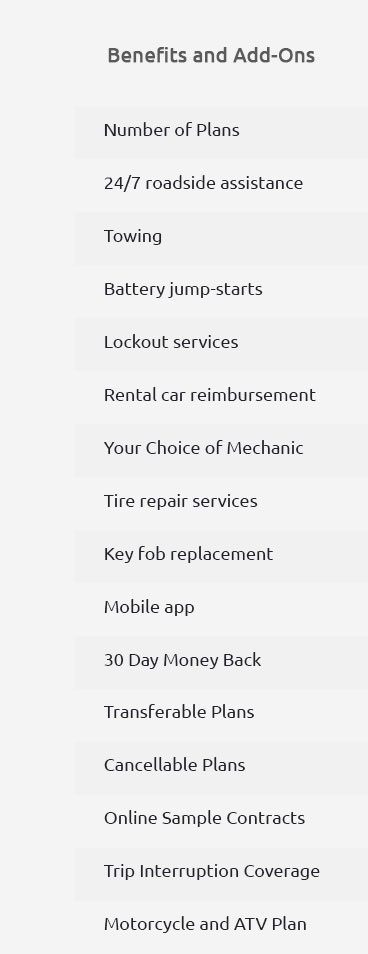

Understanding MPP Extended Car Warranty: What You Need to KnowWhen it comes to safeguarding your vehicle against unforeseen expenses, an extended car warranty can be a wise investment. One notable provider in this domain is MPP, which stands for Mechanical Protection Plan. This extended warranty offers a layer of financial security beyond the manufacturer's warranty, designed to cover the cost of specific repairs and replacements. But how does it work, and is it the right choice for you? Firstly, it's essential to understand what an extended car warranty entails. Unlike the factory warranty that comes with a new car, an extended warranty is a service contract that you purchase separately. It can cover a range of repairs depending on the plan you choose. MPP offers several options, allowing you to tailor the coverage to your vehicle's needs and your budget. This flexibility is one of the standout features of MPP's offerings. Why Consider an Extended Warranty? The primary reason car owners opt for an extended warranty is peace of mind. Vehicles today are complex, and repairs can be costly. An MPP extended warranty helps mitigate these costs, ensuring that unexpected breakdowns don't lead to financial strain. Moreover, having a warranty can enhance the resale value of your car, as potential buyers often see this as a sign of well-maintained reliability. What Does MPP Cover? Coverage varies by plan, but generally includes components like the engine, transmission, and electrical systems. Some plans even offer additional perks such as roadside assistance and rental car coverage, which can be particularly beneficial if you travel frequently or rely heavily on your vehicle. Always review the fine print of any warranty to understand what is and isn't covered.

Are There Downsides? While MPP offers comprehensive coverage, it's not without its considerations. For instance, like most extended warranties, there are exclusions and conditions that must be met. It's crucial to keep up with regular maintenance and document all service work, as failing to do so might void your coverage. Additionally, the cost of the warranty itself should be weighed against potential benefits, especially if you have a reliable vehicle model known for longevity. In conclusion, an MPP extended car warranty can be a valuable tool in protecting your investment. It offers a customized approach to coverage, catering to the specific needs of your vehicle and lifestyle. However, like any financial decision, it requires careful consideration of the terms and a thorough assessment of your vehicle's reliability. For those who prioritize peace of mind and financial predictability, it might just be the perfect fit. https://www.mpp.com/warranty-plans.htm

Our Extended Vehicle Warranties cover more than just manufacturer's defects. If a covered part fails due to wear, tear or use, We Fix It! And coverage includes ... https://www.mpp.com/warranty-plans/used-car-warranties.htm

Our Platinum coverage provides the highest level of mechanical protection and pays for parts and labor on all covered repairs. Learn more.. Gold Warranty ... https://www.mpp.com/contact-us.htm

Please Note: Our customers commonly refer to MPP Vehicle Service Contracts as extended auto warranties, car repair insurance, or even breakdown insurance, but ...

|